This is intended to be a rich dad poor dad summary. Rich Dad Poor Dad has been a very influential book in my life. The principles are fundamental to financial success and I believe that everyone should become familiar with them. I’ve searched the internet far and wide and I couldn’t find a single rich dad poor dad summary that met my standards. With that being said, my intention for the article is to provide you with a quality rich dad poor dad summary to review often instead of re-reading the book.

Rich Dad Poor Dad Summary

- The rich don’t work for money – The author states that for most individuals “the only thing that life does is push you around.” The majority of people today are risk averse and aren’t willing to take the necessary risks to make it to the top. In this rich dad poor dad summary I want to emphasize the importance of taking calculated risks. We are presented with countless opportunities in life. Most people allow these opportunities to pass them by while the rich seize the moment and create wealth from a great number of the opportunities that come their way.

- The importance of financial literacy – In this rich dad poor dad summary I also want to stress the importance of financial literacy. “Don’t try to build a skyscraper or even a house without building a strong foundation first.” The masses get caught up in the rat race of life and never truly get to creating wealth. You need to develop financial intelligence before you can create wealth and I will get into the major key of the book in the next point…

- Distinguish Assets Vs. Liabilities – In this rich dad poor dad summary I want to point out that the author states that we must know the difference between an asset and a liability, and make sure that you only control assets. More specifically when the author talks about assets he is referring to income generating assets. Most people consider a car or a house to be an asset when in fact they are their greatest expenses/liabilities. The way the rich become and stay rich is by investing in income generating assets, they make their money work for them. This is they key to cultivating financial abundance.

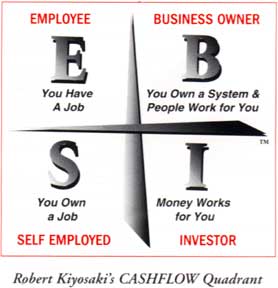

- Minding Your own business – To illustrate this important point from the book I am going to share with you a diagram from another one of Robert Kiyosaki’s books “Cash flow Quadrant”. In doing so I will be able to give you a clear visual of what it means to “Mind your own business”.

- An important thing I want to show you in this rich dad poor dad summary is that there are 4 distinct quadrants. The majority of people fall into the left side of the quadrant the employee or self employed side. What we need to do is shift to the right side of the quadrant and allow our money and other people to work for us. The rich are business owners and investors. Instead of seeking job security they seek financial abundance. As a business owner they have other people working for them. As an investor they make their money work hard for them. Doesn’t this sound appealing, making others along with your money work for you rather than working 80 hour weeks only to have people higher up make the majority of the money? The rich are business owners and investors and if you desire financial abundance you need to make that shift. NOW!

- Taxes and corporations – Taxes are the single greatest expense an individual is faced with during their lifetime. The rich have the financial intelligence and knowledge to use the power of corporations to protect and enhance their assets. The advantage of a corporation is how they are treated in regards to taxation. They key difference is individuals make money, pay taxes, and live off the remaining balance. Corporations on the other hand earn money, spend as much as they can, and pay taxes on whatever remains. The average individual works from January to May solely for the purpose of paying taxes, thats 5 months! WOW!

- The rich invent money – Most individuals never experience financial abundance because they fail to capitalize on opportunities that arise. If we want to possess and abundance of money we can’t just wait around we need to make the most of the opportunities that we are presented!

Remember you can possess all the knowledge in this rich dad poor dad summary but without taking action its useless!

Rich dad poor dad summary – ACTION PLAN: Right now list one thing your going to do differently as a result of this rich dad poor dad summary. Write it down on paper and follow through with that action today.

I hope you have enjoyed my rich dad poor dad summary. I trust that it was beneficial and helpful to you. Its crucial that you keep these concepts in mind at all times.

Come back and review the concepts of this Rich Dad Poor Dad Summary as frequently as you need to and make sure that your implementing them into your daily life.

Cheers,

bigP

tipburn

tipburn elazigoh

elazigoh sidiknurjaman

sidiknurjaman ethporn

ethporn